PCI Compliance Cost

Sample Pricing

PCI Gap Assessment

- Scope includes:

- Network Diagrams

- Configurations

- Data Flows

- Policies and Procedures

- CDE Scope

- Network Segmentation

- Security Architecture

PCI QSA Assisted SAQ Assessment

- Scope includes:

- Policies and Procedures

- Data Flows

- CHDE Storage Validation

- Network Diagrams

- Network Segmentation

- Configurations

- Security Architecture

- Complete SAQ

PCI QSA Validated ROC

- Scope includes:

- Policies and Procedures

- Data Flows

- CHDE Storage Validation

- Network Diagrams

- Network Segmentation

- Configurations

- CHDE Mapping

- Security Architecture

- Complete AOC

- Complete ROC

Elevate Your PCI Compliance Efforts in Minutes!

Join us for a 45-minute session and gain the knowledge, clarity, and customized solutions you need. Leave confusion behind and navigate PCI compliance with confidence.

In-depth understanding of PCI compliance

Personalized next steps checklist

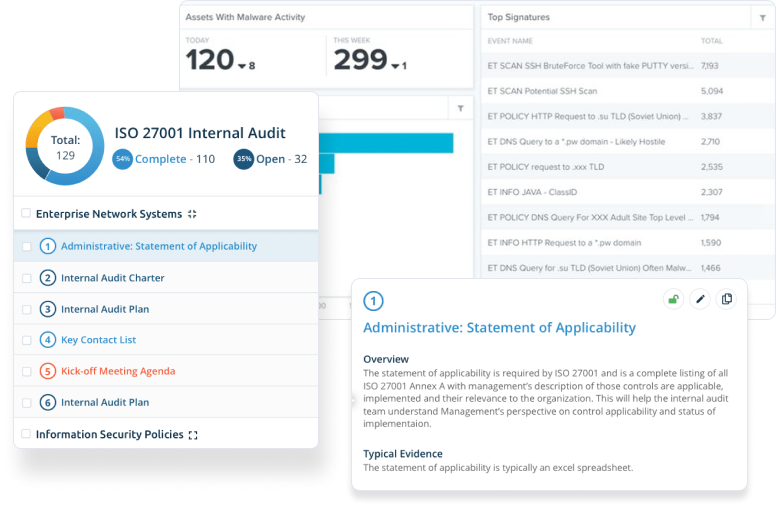

Cutting-edge compliance management platform

Save time with automated control activities

Detailed statement of work

PCI Accelerator Program

Your Fastest Path to PCI Compliance

Audit Management and Continuous Compliance by Experts

“TrustNet's extensive knowledge and experience navigating between various certification frameworks, allowed us to fast-track the audit process, leading us to complete the certification with confidence.”

Chris Hagenbuch

Principal - Canda Solutions

“TrustNet has streamlined the Compliance process for my company. With weekly project status updates and reports, I am assured that my staff is up to date on all document submissions.”

Andy Wanicka

President - Certified Medical Consultants

“TrustNet performs our annual audit. The audit team is professional, highly experienced, and very easy to work with, making the audit process very streamlined.”

Chris Porter

Director, IT and Security - Cervey

What does PCI Compliance cost?

One of the most frequently asked questions from small local businesses to large global enterprises is what does PCI compliance cost? There are three primary cost components to the PCI DSS Compliance:

PCI Gap Assessments

Initial assessment to determine the scope and identify gaps

PCI Remediation

Cost of technology, procedures, and resources to become compliant and close the gaps found in the Gap Assessment

PCI SAQ Review or Report on Compliance

Recurring annual cost to validate PCI Compliance

Any company that stores, manages, transmits, or processes data must take steps to ensure that it remains secure from theft or sabotage. To that end, the payment card industry has arrived at a set of data security standards to which all such companies must adhere. There are various costs associated with PCI compliance as well as factors that influence them, including the following:

The cost of PCI Compliance is impacted by the Merchant or Service Provider classification, scope of the PCI cardholder data environment, number of transactions, type of cardholder transactions, size of the assessed organization, number of geographic locations, and complexity of the IT infrastructure. The cost of PCI Compliance is often dependent on the skills and experience of the assessed entity’s PCI QSA (Qualified Security Assessor).

The starting cost for a typical SMB PCI Compliance project is $10,000. Managing the cost of PCI Compliance is of course very important – and a sound approach, with experienced QSA’s will provide long-term value to the organization. For over a decade TrustNet has provided cost-effective PCI Compliance services to multiple organizations, across industries, and around the world.

Regardless of what you pay, adherence to these standards is not just mandatory; doing so protects your company from breach and liability and raises your credibility in the eyes of your customers.

Schedule a Meeting With Us